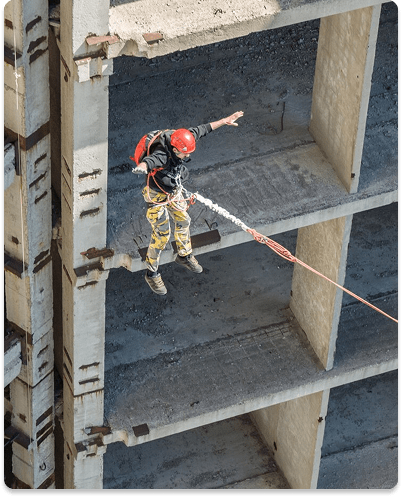

Protecting Builders, Empowering Dreams

General Liability

Our coverage

We empower the construction industry with insurance solutions that are as dynamic as your projects.

General Liability Insurance

Accidents are inevitable, such as a client tripping over a tool, but General Liability Insurance provides essential protection against third-party claims. It covers repair costs, legal fees, and common risks, including injuries, property damage, and even libel or slander. Since every business has unique needs, coverage limits and costs vary, ensuring policies are tailored for optimal protection.

Essential in Florida’s construction industry, General Liability Insurance safeguards your business from third-party claims of property damage or injury. In a high-risk trade, it provides critical financial protection while reinforcing your commitment to professionalism, risk management, and trust—ensuring stability and long-term growth.

Building Strong with the Right Protection

- Medical payments

- Property damage

- Umbrella Insurance

Guarding your operations

Commercial General Liability (CGL) insurance is a vital policy that protects businesses against claims of bodily injury, personal injury, and property damage resulting from their operations, products, or incidents on their premises.

While CGL insurance offers broad coverage, it is not all-encompassing and may require additional policies to fully address a business’s unique risks. Such as Claims-Made, Occurrence, Legal Defense, Not Intentional Damage.

Our General Liability Coverage

Roofing Contractors

Landscaping Companies

General Contractors

Wanna know more?

Reach out to us today to experience personalized service and comprehensive coverage tailored to your needs.

Visit Us

5575 A1A South, Suite 116A

St. Augustine, FL

32080, United States

Mail Us

Team@litespeedins.com

Call Us

Send us a message

We’re dedicated to blending speed with integrity, always keeping your business’s growth front and center. Our goal is to empower your success at every turn.

What does General Liability Insurance cover?

General Liability Insurance covers bodily injury, property damage, and personal injury claims that arise from your business operations. It helps protect against lawsuits and financial losses due to accidents, third-party claims, and advertising-related issues.

Is General Liability Insurance required for contractors?

While not always legally required, many clients, project owners, and state regulations mandate that contractors carry General Liability Insurance to work on construction projects. It is also a key requirement for securing business licenses and contracts.

How much General Liability coverage do contractors need?

The coverage amount depends on the size and scope of your business. Most contractors carry at least $1 million per occurrence and $2 million aggregate. Larger projects or contracts may require higher limits.

What is not covered by General Liability Insurance?

Common exclusions include:

- Employee injuries (covered by Workers' Comp)

- Faulty workmanship or defective materials

- Professional errors (covered by Professional Liability Insurance)

- Auto-related claims (covered by Commercial Auto Insurance)

How do I file a claim under my General Liability policy?

If an accident or claim occurs, report it immediately to your insurance provider. Gather documentation, witness statements, photos, and any related contracts to support your claim.

Can I add additional insureds to my General Liability policy?

Yes, you can add clients, project owners, or general contractors as additional insureds, extending some of your policy’s coverage to them as required by contracts.

What is not covered by General Liability Insurance?

Common exclusions include:

- Employee injuries (covered by Workers' Comp)

- Faulty workmanship or defective materials

- Professional errors (covered by Professional Liability Insurance)

- Auto-related claims (covered by Commercial Auto Insurance)

How much does General Liability Insurance cost?

The cost varies based on business size, industry risk, coverage limits, and claims history. Contractors can expect to pay anywhere from $500 to $3,000+ per year, depending on their risk level.