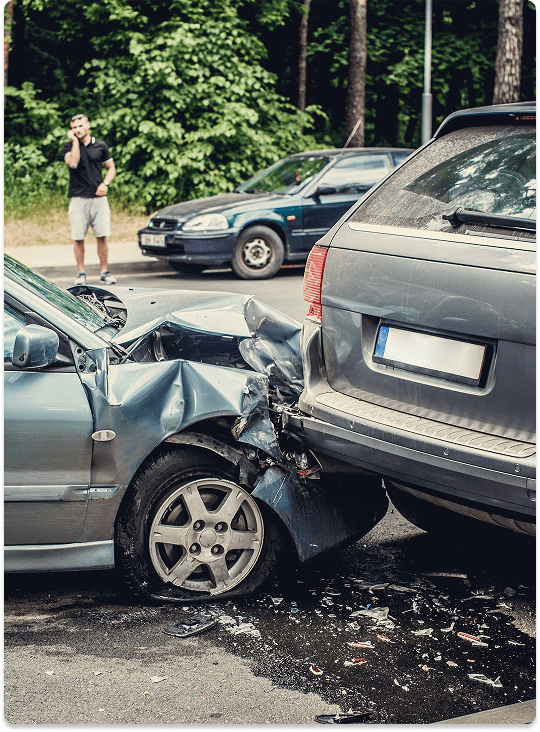

Building a Safer Path Every Step of the Journey

Commercial Auto

Our coverage

Ensure your business vehicles are fully protected with comprehensive, top-tier coverage, including:

Commercial Auto Insurance

In construction, every project is a journey, and your fleet is essential to getting there.

Who Needs it?

Our Commercial Auto Insurance is designed for contractors, covering trucks, vans, and heavy machinery from minor damage to major accidents and liabilities. Required for most contracts, it includes a $1,000,000 CSL, Hired & Non-Owned Auto Liability for rented or employee-owned vehicles, and Any Auto Coverage to protect all business-use vehicles, including new acquisitions—going beyond basic coverage to meet the industry’s unique needs.

Our Commercial Auto Insurance is designed to cover the unique risks contractors face, from transporting heavy tools and machinery to employees using personal vehicles for work. It includes liability protection for damages your vehicles may cause to other property or individuals, ensuring your business stays protected.

With customizable options like non-owned vehicle insurance and cargo protection, you can build a policy that fits your needs perfectly.

Additional coverages, such as rental reimbursement and towing assistance, help keep your projects on track even if a work vehicle is out of commission. Whether it’s a roadside emergency or an unexpected delay, our coverage ensures that your fleet, employees, and bottom line are protected—so you can focus on what you do best, building and creating.

Wanna know more?

Reach out to us today to experience personalized service and comprehensive coverage tailored to your needs.

Visit Us

5575 A1A South, Suite 116A

St. Augustine, FL

32080, United States

Mail Us

Team@litespeedins.com

Call Us

Send us a message

We’re dedicated to blending speed with integrity, always keeping your business’s growth front and center. Our goal is to empower your success at every turn.

What is Commercial Auto Insurance?

Commercial Auto Insurance provides coverage for business-owned or work-used vehicles, protecting against liability, collisions, and other risks associated with commercial driving. It covers accidents, property damage, injuries, and legal expenses related to business vehicle use.

What does Commercial Auto Insurance cover?

Liability Coverage (Pays for third-party injuries and property damage if you're at fault in an accident), Collision Coverage (Covers damages to your business vehicle in an accident, regardless of fault), Comprehensive Coverage (Protects against theft, vandalism, fire, and natural disasters), Medical Payments (MedPay) or Personal Injury Protection (PIP) (Covers medical expenses for you and passengers), Uninsured/Underinsured Motorist Coverage (Protects your business if another driver lacks insurance or has insufficient coverage).

Who needs Commercial Auto Insurance?

Any business that owns, leases, or uses vehicles for work-related purposes should have Commercial Auto Insurance. This includes contractors, delivery services, trucking companies, real estate agents, food businesses, and construction companies.

How is Commercial Auto Insurance different from Personal Auto Insurance?

Commercial Auto Insurance is designed for business-related driving, covering higher liability limits, multiple drivers, and vehicle use in construction, deliveries, or client transportation. Personal Auto Insurance won’t cover most business-related accidents.

Can I add employees as drivers under my Commercial Auto policy?

Yes, but all employees must be listed on the policy, and their driving records may affect your premium. Some policies allow hired and non-owned auto coverage for employees who use personal vehicles for work.

Do I need Commercial Auto Insurance if I use my personal vehicle for work?

Yes, if you use your personal vehicle for business purposes beyond commuting, such as making deliveries, transporting equipment, or visiting job sites, a personal auto policy may deny claims. A Commercial Auto or HNOA policy is required.

What happens if an uninsured driver hits my business vehicle?

If the at-fault driver has no insurance or insufficient coverage, Uninsured/Underinsured Motorist Coverage on your Commercial Auto policy helps pay for damages and medical costs.

Would you like this tailored for construction businesses, contractors, or another industry?

What is not covered by Commercial Auto Insurance?

It does not cover:

- Personal use of a business vehicle (unless specified in the policy)

- Employee-owned vehicles used for business (covered under Hired & Non-Owned Auto Insurance)

- Tools and equipment inside the vehicle (requires Inland Marine Insurance)

- Intentional damage or illegal activity